Unlock Rewards: The Benefits of Loyalty Programs and Cashback Cards for Savvy Shoppers

In a world where every dollar spent can feel like a mere drop in the ocean of expenses, savvy shoppers are discovering that their purchases can yield more than just products and services. Enter the realm of loyalty programs and cashback cards—two dynamic tools designed to transform everyday spending into rewarding experiences. Whether you’re a frequent flyer accumulating miles for your next getaway or a grocery shopper who prefers points that lead to discounts, these programs serve as a gateway to unlocking a treasure trove of benefits. This article delves into the myriad advantages these financial tactics offer, empowering consumers to make informed choices that stretch their purchasing power and enhance their shopping journeys. Join us as we explore how to navigate this intricate landscape and make the most of your spending, transforming routine transactions into valuable rewards.

Maximizing Value with Strategic Loyalty Memberships

By leveraging strategic loyalty memberships, savvy shoppers can significantly amplify their shopping experience and boost savings. These programs are designed to reward loyal customers while fostering a community of brand enthusiasts. Key components that maximize value include:

- Exclusive Discounts: Members often enjoy premium discounts on select items or services, which can lead to substantial savings over time.

- Personalized Offers: Utilizing purchase history allows brands to tailor promotions that specifically cater to individual shoppers’ preferences.

- Point Accumulation: Customers earn points for every purchase, which can be redeemed for future discounts, making every transaction count.

- Tiered Rewards: Many programs feature tier levels where increased spending unlocks greater rewards, encouraging ongoing engagement.

- Early Access: Loyalty members often receive early notifications about sales, new products, and exclusive events, enhancing their shopping experience.

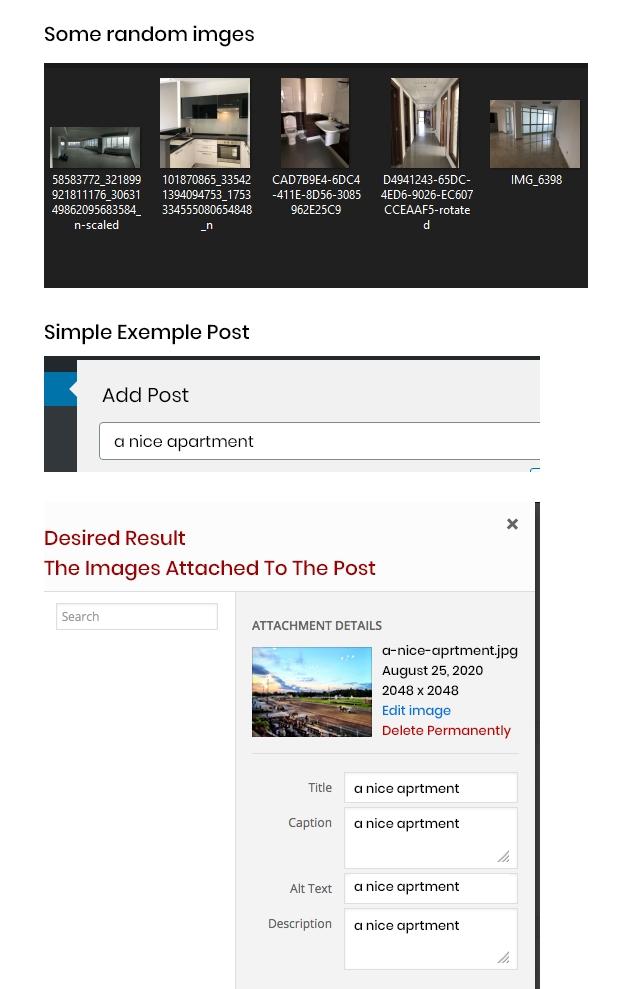

Understanding the different loyalty programs available can help maximize their benefits. Here’s a quick comparison of popular options:

| Program Type | Key Feature | Best For |

|---|---|---|

| Retail Loyalty | Points for Purchases | Frequent Shoppers |

| Credit Card Cashback | Percentage Back on Purchases | Everyday Expenses |

| Travel Rewards | Miles for Flights | Travel Enthusiasts |

By strategically joining programs that align with their spending habits, consumers can unlock a world of rewards that elevate their shopping experience to new heights.

Leveraging Cashback Cards for Enhanced Shopping Experiences

Cashback cards offer a world of possibilities that can significantly enhance your shopping experience, transforming mundane purchases into rewarding opportunities. By utilizing these financial tools, you can earn back a percentage of your spending, making every dollar count. Here are some innovative ways to maximize the benefits of cashback cards:

- Strategic Spending: Use your cashback card for regular bills or significant purchases to accumulate rewards quickly.

- Stacking Rewards: Combine cashback with other loyalty programs for a double dip on rewards.

- Targeted Bonuses: Keep an eye out for rotating cashback categories or promotional offers for additional earnings.

- Budgeting Tool: Leverage your spending habits tracked through the card to better manage finances while earning rewards.

| Cashback Type | Typical Rate | Recommended Use |

|---|---|---|

| Grocery Shopping | 1.5% – 5% | Daily Essentials |

| Dining Out | 2% - 4% | Restaurants and Cafes |

| Online Retailers | 1% – 3% | General Online Shopping |

Incorporating cashback cards into your regular shopping routine not only rewards you for your purchases but also empowers you to make informed spending choices that align with your financial goals.

Final Thoughts

In a world where every dollar counts, savvy shoppers are continually on the lookout for ways to maximize their spending. Loyalty programs and cashback cards provide an enticing avenue to stretch those hard-earned dollars a bit further. By choosing to engage in these rewarding schemes, consumers not only unlock a treasure trove of benefits but also cultivate habits that can lead to substantial savings over time.

As we wrap up our exploration of these powerful financial tools, it becomes clear that the path to smarter shopping is paved with strategic choices and informed decisions. With each purchase, you open the door to exclusive rewards, discounts, and perks tailored to enhance your shopping experience.

So, whether you’re a frequent flyer, a coffee connoisseur, or simply someone who enjoys the occasional splurge, remember that every point earned or dollar saved is a step toward enriching your financial journey. Embrace the rewards that await you and watch as your diligence transforms into delightful benefits. Happy shopping, and may your loyalty always be rewarded!