Emergency Fund 101: Why You Need It and How to Start

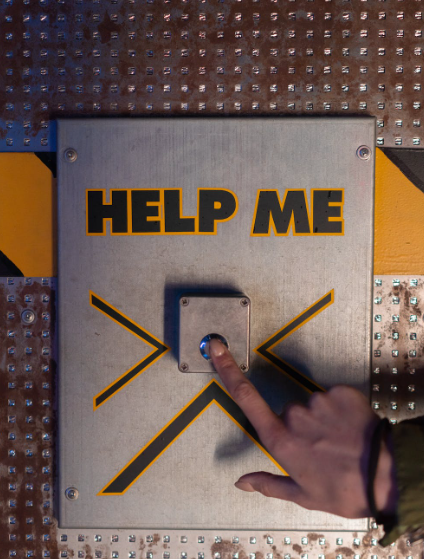

An emergency fund is more than just another financial buzzword. It’s your safety net in a world filled with financial uncertainties. In this article, we’ll delve into what an emergency fund is, why it’s crucial, and how you can start building one to safeguard your financial future.

What Is an Emergency Fund?

An emergency fund is a dedicated pool of money set aside to cover unexpected expenses, such as medical emergencies, car repairs, or sudden job loss. Unlike regular savings, which you might use for planned expenses like vacations, an emergency fund is exclusively for unforeseen financial challenges. Think of it as your financial “Plan B.”

The Importance of an Emergency Fund

Financial Security and Peace of Mind

Having an emergency fund provides a sense of security that few other financial strategies can match. Knowing that you have money set aside for life’s unexpected curveballs can bring tremendous peace of mind. You won’t need to stress about where the funds will come from when a crisis strikes.

Protection Against Unexpected Expenses

We all encounter unexpected expenses, from medical bills to home repairs. An emergency fund ensures that you won’t need to rely on credit cards or loans, which can lead to debt and financial stress. Instead, you can use your fund to weather the storm without accruing high-interest debt.

Reducing Reliance on Credit

By having an emergency fund, you can avoid the pitfalls of using credit as your financial safety net. Credit cards and loans come with interest rates that can compound your financial problems. With an emergency fund, you can maintain your financial independence and avoid unnecessary debt.

How Much Should You Save?

The general rule of thumb is to save at least three to six months’ worth of living expenses in your emergency fund. However, the ideal amount may vary depending on your circumstances. Consider your job stability, family size, and any potential financial risks. Saving more can provide an even greater cushion.

Where to Keep Your Emergency Fund

Choosing where to store your emergency fund is a crucial decision. Common options include a high-yield savings account, a money market account, or even a dedicated cash envelope. Each choice has its pros and cons, so select the one that aligns with your financial goals and accessibility needs.

Building Your Emergency Fund

Consistency is key to building your emergency fund. Set up automatic transfers to your fund as soon as you receive your paycheck. Additionally, consider budgeting for unexpected expenses. Redirect windfalls, such as tax refunds or bonuses, into your fund to accelerate its growth.

What Constitutes an Emergency?

Distinguishing between true emergencies and non-emergencies is essential. An emergency fund should only be used for genuine crises, like unexpected medical expenses or essential home repairs. Using it for non-essential purchases can deplete your fund unnecessarily.

When to Start Building Your Emergency Fund

The best time to start building your emergency fund is now. Procrastination can leave you vulnerable to unexpected financial setbacks. Begin by setting a clear savings goal and make a commitment to stick with it. Every dollar saved is a step toward financial security.

Handling Financial Setbacks

If you’re currently facing a financial crisis without an emergency fund, all hope is not lost. Evaluate your financial situation, cut unnecessary expenses, and explore opportunities for additional income. It may take time, but you can still recover and establish a financial safety net.

Maintaining Your Emergency Fund

Regularly review and adjust your emergency fund as needed. Life circumstances change, so ensure your fund remains in line with your current expenses and financial goals. Guard against the temptation to use the fund for non-emergencies.

Case Studies

Let’s explore some real-life examples of how having an emergency fund saved the day for individuals. By learning from their experiences, you can better understand the power of this financial tool and how it can be a game-changer when it matters most.

The Psychological Aspect

It’s not just about money; it’s about peace of mind. Having an emergency fund can reduce stress and anxiety, leading to better decision-making during difficult times. This psychological benefit is just as valuable as the monetary security it provides.

Emergency Fund vs. Investments

Balancing an emergency fund with your long-term financial goals is essential. While investments offer potential growth, your emergency fund ensures financial stability in the short term. Learn how to strike a balance that works for your unique situation.

Common Mistakes to Avoid

In your journey to establish and maintain an emergency fund, it’s important to be aware of common pitfalls. Avoiding these mistakes can help you stay on track and ensure your fund is ready to assist you when needed.

Conclusion

In conclusion, an emergency fund is not a luxury but a necessity for a financially secure future. It serves as your financial safety net, protecting you from unexpected expenses and the potential pitfalls of relying on credit. The peace of mind it brings is invaluable, and the sooner you start, the better off you’ll be.

FAQs:

- What if I can’t save three to six months’ worth of expenses right away?

- Start with a smaller goal, like one month’s expenses, and gradually increase it as your financial situation improves.

- Can I invest my emergency fund for higher returns?

- It’s generally not advisable to invest your emergency fund, as it should be easily accessible. However, you can consider low-risk, liquid options.

- How often should I review and update my emergency fund savings?

- It’s a good practice to review your fund at least annually or whenever you experience significant life changes.

- What if I have an emergency before my fund is fully established?

- Use whatever you have in your fund to cover the immediate expense, and continue building it as soon as possible.

- Is there a specific age at which I should start building an emergency fund?

- It’s never too early to start. The sooner you begin, the more prepared you’ll be for life’s uncertainties.